Climate-Related Financial Risk: What is Extreme Weather Telling Us About the Future of Financial Risk Management for Financial Institutions?

Posted in Insights, VBC Advisors

It is no surprise to anyone that the Summer of 2022 has been extremely hot and dry, prone to flash floods on the one hand, and devastating wildfires on the other. “Extreme weather” appears to have become our new normal, as anyone who lives in the cities, states and regions affected by these events knows firsthand, or anyone with even a cursory review of recent weather headlines can attest:

- “Grim warnings issued as oppressive U.S. heat wave spreads”

- “Extreme heat prompts alerts in 28 states as Texas, Oklahoma hit 115”

- “California fires are so severe some forests might vanish forever”

- “’It goes up like tinder’: unprecedented blazes envelop Alaska”

- “Evacuation order lifted as Texas wildfires burn amid heat”

- “Texas residents asked to ‘immediately’ conserve water amid drought, extreme heat”

- “Arkansas cattle producers facing ‘disaster’ as record drought conditions worsen”

- “Rapid drought development possible in Nebraska as heat continues”

- “Arizona cities respond to the worst drought in over a thousand years with a new plan”

- “State leaders updated on Montana wildfire danger, drought conditions”

- “After major floods, Kentucky grapples with the damage left behind”

- “Extreme flooding leads to Midwest flooding”

- “Flash floods swamp St. Louis in latest bout of extreme US weather”

Weather events have become more persistently extreme and occur with an increasing regularity far in excess of the proverbial “1,000 or 100 year” flood, drought, or wildfire disaster that was the standard frequency expectation before science confirmed that earth’s warming atmosphere to be an empirical reality resulting from a changing climate. As succinctly summarized by the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) issued in February 2022: “Climate change, through hazards, exposure and vulnerability generates impacts and risks that can surpass limits to adaptation and result in losses and damages.”1

Climate risk standard practice is to distinguish between physical and transition risks due to climate change. Transition risks refer to business-related risks that result from societal and economic shifts to a low- carbon future. Transition risks can include policy and regulatory risks, technological risks, market risks, and legal risks.2 Physical risks are distinguished between acute and chronic risks. Physical risks that are chronic include risks such as persistently rising temperatures, drought, rising sea levels due to glacier melting, or expanding vectors of rare diseases as humans become more exposed to tropical pests. Acute physical risks include extreme weather events that are increasingly more prevalent such as “super storms,” flooding and wildfires.

1 Climate Change 2022, Impacts, Adaption and Vulnerability, Summary for Policymakers, Working Group II contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, February 27, 2022, p. 4.

2 GRESB: The global ESG benchmark for financial markets (gresb.com).

Given the tangible nature of acute physical risks resulting from climate change, risks that many of us now experience with increasing regularity, it is worthwhile to ask: what is extreme weather (acute physical risk) telling us about the future of risk? Or because we at VBC Advisors work so closely with banks and financial institutions, what is extreme weather telling us about the future of financial risk? Are banks located in cities, states and regions where extreme weather events are acutely experienced more exposed to financial risks, and if so, what should these financial institutions be doing to measure and mitigate (manage) these risks?

The OCC and FDIC recently published principles for large banks (banks with assets greater than $100 billion) for the management of climate-related financial risks.3 This is a significant development and reflects the growing awareness that financial institutions located in cities, states, or regions where climate-related risks (most especially physical risks) are on the rise should be considering what such risks mean for their loan exposures, for their capital and liquidity profiles, for their operations, and for their enterprise risk management (ERM) and risk appetite frameworks.

Consistent with the principles published in June 2022 by the Basel Committee for Banking Supervision (BCBS)4 and the long-standing principle of proportionality (i.e., risk measurement and mitigation efforts should be commensurate with an institution’s size, complexity, and risk profile), we asked ourselves: what should smaller financial institutions consider doing to prepare for, manage through, and mitigate against climate-related financial risks? To help us answer this question, we will refer to the BCBS principles which present reasonable and common-sense suggestions for effective management of climate-related financial risks.

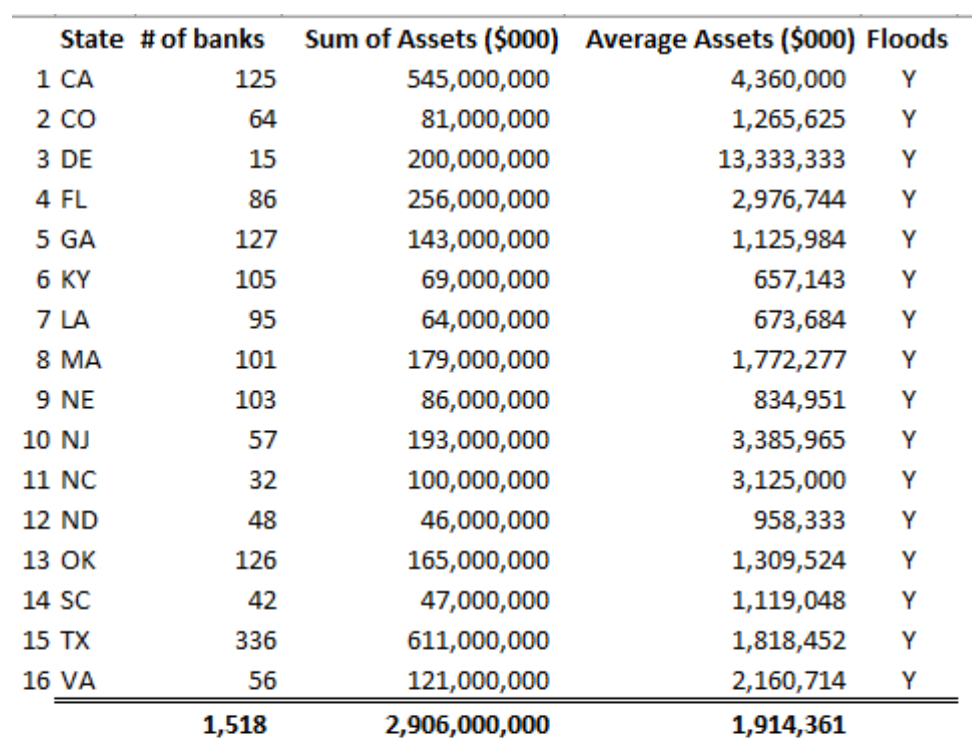

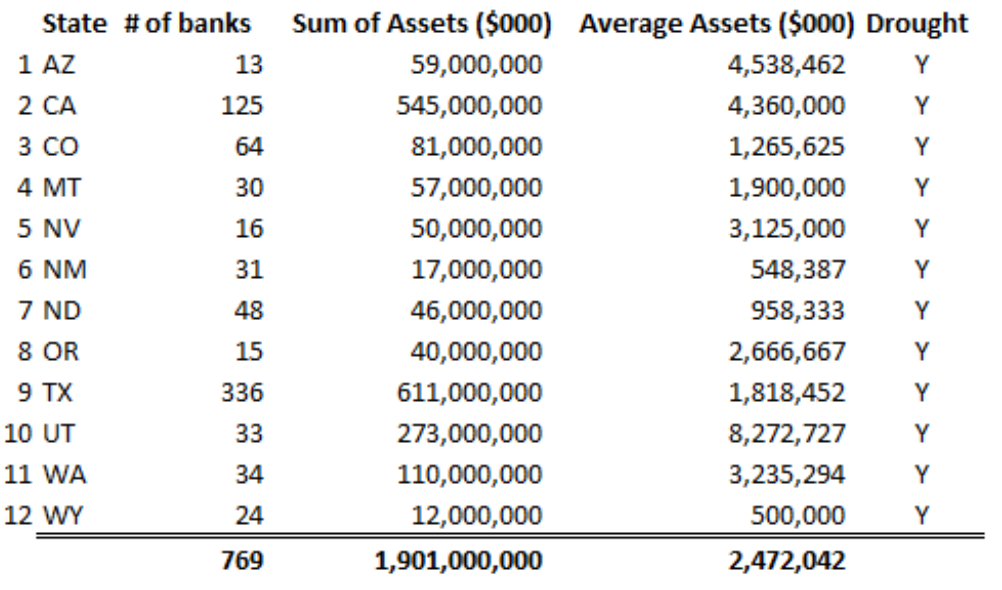

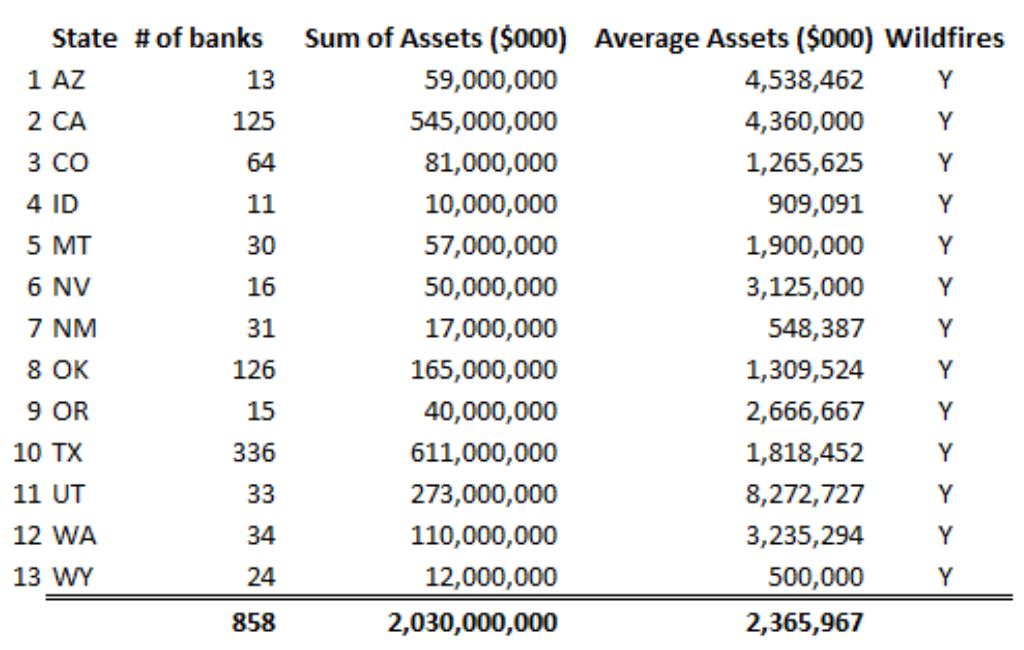

But before we explore the BCBS principles, we wish to know the number and the aggregate assets of smaller banks currently active in the states most affected by extreme weather. By extreme weather, we mean both chronic (droughts) and acute (flooding and wildfires) physical risks that have been so prevalent and so widely reported over these summer months of 2022. As illustrated by the tables below, the number and aggregate assets of smaller banks operating in states where extreme weather is occurring most frequently and with the greatest impact are not trifling or insignificant.

3 Office of the Comptroller of the Currency, Principles for Climate-Related Financial Risk Management for Large Banks, December 2021; Federal Deposit Insurance Corporation, Statement of Principles for Climate-Related Financial Risk Management for Large Financial Institutions, April 2022

4 Basel Committee on Banking Supervision, Principles for the effective management and supervision of climate-related financial risks, June 2022, Bank of International Settlements.

Active Banks1 Located in States Experiencing Extreme and Persistent Flooding2, 3

Source: FDIC, January 2022

1Banks are banks with assets greater than $100 million but less than $100 billion.

2“10 States Most at Risk of Flooding,” US News and World Report, March 14, 2012 (https://www.usnews.com/news/slideshows/10-states-most- at-risk-of-flooding).

3“US States Most Prone To Flooding,” World Atlas, July 16, 2020 (https://www.worldatlas.com/articles/us-states-most-prone-to-flooding.html).

Active Banks1 Located in States Experiencing Extreme and Persistent Drought2

Source: FDIC, January 2022

1Banks are banks with assets greater than $100 million but less than $100 billion.

2“Drought Map of US: These 11 States Are Suffering From Historic Levels of Extreme Drought,” Newsweek, June 24, 2021 (https://www.newsweek.com/drought-map-us-these-11-states-are-suffering-historic-levels-extreme-drought-1603762).

Active Banks1 Located in States Experiencing Extreme and Persistent Wildfires2

Source: FDIC, January 2022

1Banks are banks with assets greater than $100 million but less than $100 billion.

2“Facts + Statistics: Wildfires,” Insurance Information Institute, October 2021 (https://www.iii.org/fact-statistic/facts-statistics-wildfires).

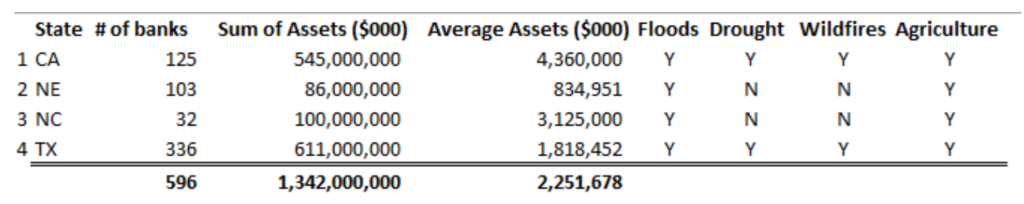

In total, more than 1,700 smaller banks with aggregate assets of more $3.5 trillion are located in states acknowledged to be the most at risk from extreme weather. The risk of extreme weather is especially problematic for top agricultural producing states with California and Texas as prime agricultural states particularly exposed to the “trifecta” of floods, droughts, and wildfires as summarized by the table below. More than $1.1 trillion of aggregated assets is held by smaller banks in California and Texas combined; many of these banks are now likely experiencing firsthand the most dramatic effects of extreme weather affecting their local communities, markets, and geographic footprints.

Active Banks1 Located in Prime Agricultural States2 Experiencing Extreme and Persistent Weather- Related Events: Floods, Drought, Wildfires

Source: FDIC, January 2022

1Banks are banks with assets greater than $100 million but less than $100 billion.

2“Top 10 Agricultural Producing States in 2022,” Rural Strong Media, Accessed August 2022 (https://ruralstrongmedia.com/top-10-agricultural- producing-states-in-2022/)

While smaller banks located in extreme weather states will experience the direct effects of these disasters on their physical locations and operations, the banks’ depositors and borrowers will experience potentially devastating risks to the values of their homes and businesses, their livelihoods, and for agricultural producers, the loss of crops and livestock. Insurance may provide coverage for destroyed homes and businesses, as well as lost crops and livestock, however, banks providing financing for residential and commercial real estate, working capital loans for small businesses, or agricultural lending will still face devaluation risks to underlying collateral for CRE loans and residential mortgages, as well as increased risk of default due to the aftereffects of extreme weather events.

This combination of increased loss-given-default (LGD) and probability of default (PD) due to extreme weather implicates a bank’s estimate of expected losses which will directly affect credit access, loan pricing, and loss reserving. It is not clear whether or to what extent smaller banks in these locations are sufficiently assessing these risks, preparing for them, measuring them, and correctly pricing their loans in light of such events. While the OCC and FDIC have focused their attention on the larger banks, smaller banks located in cities, states, and regions experiencing increasingly frequent and persistent extreme weather events remain nonetheless exposed to climate-related financial risks. The BCBS Principles for Effective Management of Climate-Related Financial Risks includes recommendations and best practices that align very closely to those of the OCC and FDIC but apply proportionality principle when evaluating such risks, which is especially important for smaller institutions.

Banks are potentially exposed to climate-related financial risks regardless of their size, complexity, or business model. Climate-related financial risk drivers can translate into traditional financial risk categories. Banks should therefore consider the potential impacts of climate-related risk drivers on their individual business models and assess the financial materiality of these risks. Banks should manage climate- related financial risks in a manner that is proportionate to the nature, scale and complexity of their activities and the overall level of risk that each bank is willing to accept.5

We now turn to a closer look at the BCBS principles and how these may benefit financial institutions seeking to better anticipate and manage climate-related financial risks while ever mindful of the importance of the principle of proportionality.

BCBS Principles Relating to Corporate Governance

Of the 12 principles relating to the effective management of climate-related financial risks three are

specific to corporate governance: development and implementation of a sound process for understanding and assessing the potential impacts of climate-related risk drivers on bank business models and operating environments; clear assignment of climate-related responsibilities to the board and senior management and effective oversight of climate-related financial risks; and, the adoption of appropriate policies, procedures, and controls to ensure effective management of climate-related financial risks across the entire organization. When developing and implementing business strategies, bank should take material physical and transition risk drivers into consideration (to the extent practicable consistent with the proportionality principle). The resilience of bank business models to material physical and transition risk over the short, medium, and long terms should be evaluated and understood. Board and senior management should be involved throughout this process, and any approach established by the board should be clearly communicated across the organization. To ensure that the board and senior management have an adequate understanding of climate-related financial risks, banks should “build capacity and train the board and senior management on climate-related topics” which can be accomplished internally or via external collaboration with subject matter experts or expert organizations. Banks should also ensure that relevant functions and business units are provided with adequate resources and expertise to fulfill responsibilities regarding climate-related financial risk management effectively and efficiently.

5 Ibid., Paragraph 7.

BCBS Principles Relating to the Internal Control Framework

Climate-related financial risks should be incorporated into existing internal control frameworks across

the three lines of defense to “ensure sound, comprehensive and effective identification, measurement, and mitigation of material climate-related financial risks.”

When conducting climate-related risk assessments for example during client onboarding, credit application and credit review processes, and in new product or business approval processes, first line of defense staff should be sufficiently informed and aware to identify potential climate-related financial risks. This would include knowing the bank’s on-balance sheet and operational exposure to extreme weather events (both acute and chronic physical risks) such flooding, droughts, and wildfires.

For the bank’s second line risk function, climate-related risk assessments and monitoring should occur independently from the first line of defense. This would include “challenging the initial assessment conducted by the first line of defense.” The internal audit function, the bank’s third line of defense, should provide “independent review and objective assurance of the quality and effectiveness of the overall internal control framework” paying particular attention to changes in methodology, business, and risk profile, as well as the quality of the underlying data used to measure climate-related financial risks across the institution.

BCBS Principles Relating to Capital and Liquidity Adequacy

While smaller banks may not need to conduct detailed internal capital and liquidity adequacy

assessments per regulatory mandate, banks should still identify and quantify climate-related financial risks deemed material by the bank when measuring and evaluating their capital and liquidity adequacy profiles given assumed stressed conditions. For example, banks should assess whether or to what extent climate- related financial risks would cause material net cash outflows or loss of liquidity buffers under both business- as-usual and stressed conditions. Such capital and liquidity adequacy assessments would incorporate (where appropriate) “physical and transition risks that are relevant to a bank’s business model, exposure profile, and business strategy.” Building risk analysis capabilities that would allow banks to identify relevant climate- related risk drivers, to develop key risk indicators and metrics to quantify exposures to these risks, and to assess the links between climate-related financial risks and traditional risk types (e.g., credit risk) will enable banks to more proactively assess the impact of climate-related risks on their projected capital and liquidity positions.

BCBS Principles Relating to the Risk Management Process

A risk management process as referenced by the BCBS Principles relates to risk appetite and risk

management frameworks; both should consider all material climate-related financial risks to which a bank is exposed and “establish a reliable approach for identifying, measuring, monitoring, and managing those risks.” For example, boards and senior management should ensure that a bank’s risk appetite framework clearly defines and includes material climate-related financial risks to which the bank is exposed. Comprehensive (firm-wide) assessments of climate-related financial risks together with clear definitions and thresholds for materiality should be performed on a regular basis. In conjunction with such enterprise-wide risk assessments, banks should consider all effective risk mitigation measures such as the establishment of internal risk limits for applicable types of material climate-related financial risks including credit, market, liquidity, and operational risks.

In the second part of this two-part series, we will take a closer look at BCBS principles relating to risk monitoring and reporting, the management of specific risk types, climate risk data, and climate scenario analysis. We will also review the climate risk disclosure requirements for smaller, publicly traded banks following from the SEC’s proposed rule6 released in March 2022, and how such financial statement disclosures will be important for financial institutions seeking to more proactively manage their climate- related financial risks.

Beyond the extremely hot temperatures, extremely dry conditions, the frequency and intensity of wildfires, and record-breaking precipitation and devastating floods, extreme weather may be signaling to affected financial institutions that a more proactive posture relative to climate-related financial risk may make sense especially while business conditions remain sufficiently favorable to measure and mitigate such risks expeditiously and cost effectively.

6 Securities and Exchange Commission, The Enhancement and Standardization of Climate-Related Disclosures for Investors, Proposed Rule, March 2022.

James L. Glueck, CAMS, CFA, FRM, SCR

Managing Director, VBC Advisors

What's the potential cost of not leveraging the experience, tools, and talent VBC brings to the table?