$10 Billion Crossover Readiness Preparation and Planning

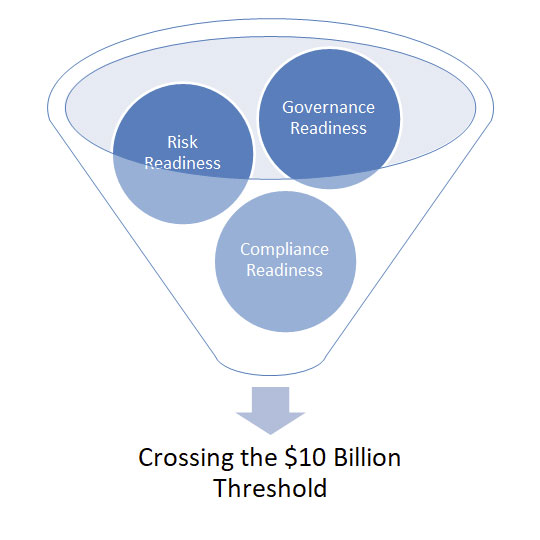

With growth comes reward. If you are a banking institution, it also comes with an additional burden of heightened regulatory scrutiny, especially when crossing $10 billion in consolidated assets. Passing this threshold successfully requires careful planning and preparation, especially with respect to the readiness of Governance, Risk, and Compliance (GRC) systems and frameworks.

Preparing for this milestone can seem overwhelming. The costs and benefits of making such a transition must be carefully evaluated. The internal culture and requirements associated with maintaining and managing governance, risk and compliance systems will undergo important changes and transformations. GRC readiness involves expanded requirements relating to internal controls, corporate governance, and oversight (Governance). It also involves increased capabilities and attention for Risk, especially model risk management (MRM), third-party risk management (TPRM), and enterprise risk management (ERM). Additionally, the scope of Compliance capabilities and requirements expands considerably for BSA/AML, Fair Lending, and Conduct Risk.

When engaging with our clients, our skilled and experienced experts expressly consider the size and complexity, business model, risk appetite, and prevailing risk culture while providing an independent perspective on Institution processes and preparedness initiatives relating to any expanded regulatory scope or heightened supervisory concern impacting GRC requirements.

What we do:

- Strategy formulation

- Current vs Future State gap assessments

- GRC management system reviews and evaluations

- GRC framework development and implementation

- Policy and procedures development

- and implementation

- Internal risk controls and reporting

- Predictive modeling and growth strategy forecasting through our Applied Quantitative Resource Team

- Staff and line augmentation

- Regulatory Compliance readiness reviews

What we deliver:

- Comprehensive, fit-for-purpose and right-sized GRC frameworks

- Transparent policy and procedures with supporting and fully implementable templates

- Training and enablement for Board, senior management, and business line heads

- Independent risk assessments and gap analysis

- Roadmap articulation, development, and socialization

- Actionable and independent guidance from our skilled resources

- More than 50 years of combined experience working with hundreds of financial institutions seeking to establish or expand their GRC frameworks and systems

Whether such expanded scrutiny involves MRM, Financial Crimes Compliance, Third Party Risk Management, Board and Senior Management Oversight, Risk Reporting, Fair Lending, Conduct Risk, or the development, implementation, and verification of growth forecasting models and modeling frameworks, VBC Advisors will ensure that your transition past the $10 billion threshold is supported and facilitated with expert guidance, delivered cost-effectively, and according to the highest industry standards. Our banking, risk, and compliance experts can assist you to assess the long-term impacts of crossing the $10 billion threshold, while also preparing for and meeting the near-term requirements while balancing the profitability risks against the expanded regulatory expectations of this milestone event.

What's the potential cost of not leveraging the experience, tools, and talent VBC brings to the table?