Credit Risk: The Third Leg of Risk in 2023

Posted in Asset Liability Management, Credit Risk, Insights, Liquidity Risk

Haverford, PA, March 23, 2023

The recent failures of Silicon Valley Bank (SVB) and Signature Bank shined the spotlight on the realities of interest rate risk and liquidity risk. Unrealized losses became relevant when coupled with a period of exacerbated liquidity risk. Simulations of reduced equity became a reality. Yet another risk to keep a close eye on is credit risk as economic volatility begins to take off, for the loan portfolio and for investments.

Pandemic, Stimulus, and Increased Lending

With the response to SVB and Signature Bank, the consensus of a soft-landing economic recession seems less tenable. What we are now facing is an uneven recession with unpredictable stress points, augmenting credit risk factors set in place after the pandemic.

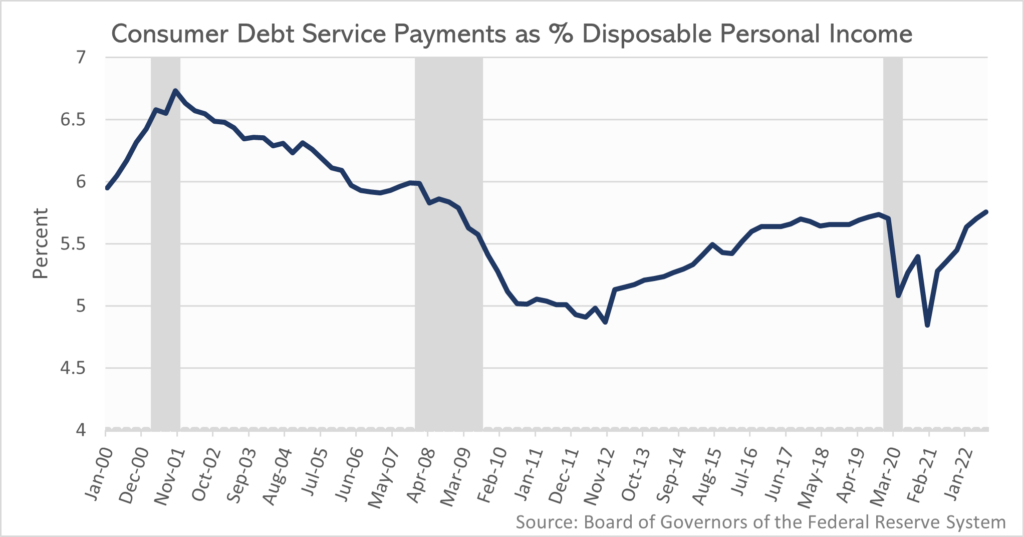

The federal relief stimulus to consumers initially reduced consumer debt. Consumer debt service payments as a percentage of personal income declined as these funds were used by many to pay down debt. Then as the nation emerged from the pandemic, consumers and businesses increased their borrowing. Consumer debt service payments went from a multi-year low in January of 2021 to the highest rate since during the Great Recession at the end of the fourth quarter 2022. Credit card delinquency rates have followed a similar trend.

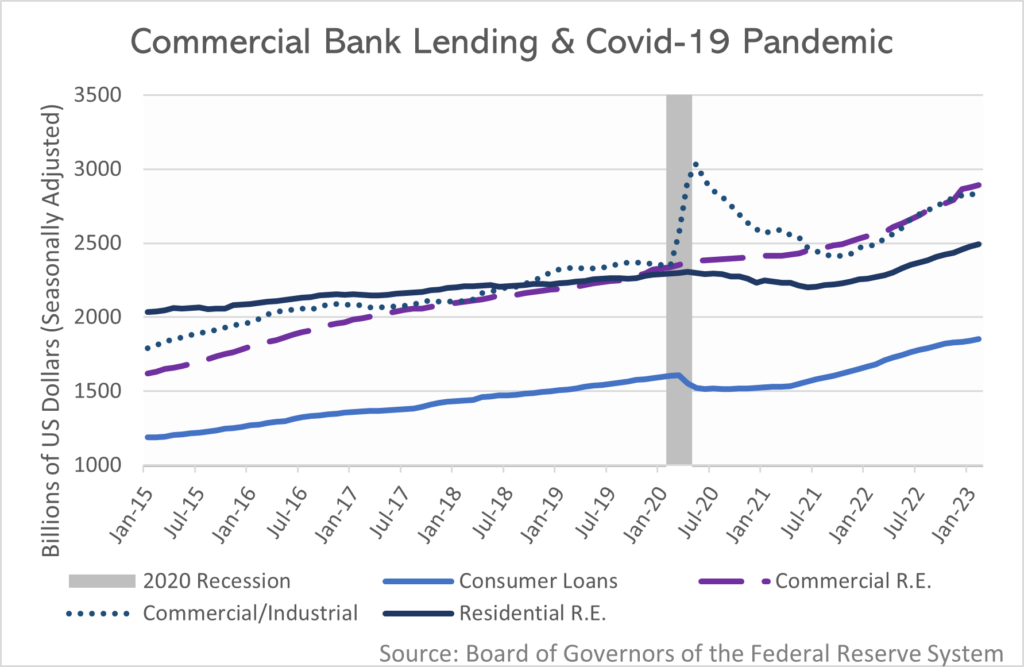

After an initial reduction in debt, consumer and residential real estate loan volume both increased at a higher rate than prior to the pandemic. Residential real estate long growth has been the strongest. This boost in the purchase of big-ticket items accelerated the economy. Yet increased demand, supply chain shortages, and the increase in the money supply, has brought inflationary pressures, making fixed costs and borrowing at higher interest rates more expensive for consumers. With less spending power and a sudden increase in debt, credit problems could surface. This has already been demonstrated in the auto industry.

Commercial and commercial real estate lending has surged the most with the rise in deposits and the economic activity of a nation exiting a public health crisis. Initially, PPP lending increased banks’ involvement in the commercial space. Commercial lending peaked and began to decline in January of 2023, with the reduction in liquidity. Commercial real estate continues to face impacts from the pandemic including a permanent remote work culture and changes to retail behavior. The contagion of SVB and Signature is also a concern.

Credit Risk in the HTM Portfolio

Given the interest rate risk and duration concerns in the HTM portfolio, the credit risk of investments must be carefully understood and monitored at this time especially as economic activity becomes more volatile. Many banks had put their deposits to work in longer maturity investments in order to obtain yield while interest rates were low. Fed policy changes then produced a textbook demonstration in interest rate risk and devalued investments.

Bankers must be able to vouch for the credit quality of each investment through maturity. It is far better to detect credit problems early and sell riskier investments at a loss than to encounter a problem credit late. If the markets become aware of a problem credit in this environment, these investments could become further devalued and the opportunity to sell them limited.

Stay on Top of Municipal Credit Risk

Municipal investments typically compose a major portion of the HTM portfolio and pose their own set of credit risk factors. Generally speaking, for states and local governments, municipal credit quality is strong. While the pandemic was a major disruption in municipal operations, unprecedented federal aid provided in the CARES Act and the American Rescue Plan Act, and a surge in sales and income tax receipts, have lifted municipal credit quality to a high point for many issuers.

From this point, municipalities will be required to obligate their ARPA funds not accounted for as lost revenue by FY 2024. Moving forward they face inflationary pressures, on-going pension concerns, and an economic recession that could drag down property value growth and halt the wave of government aid that they have grown accustomed to. Banks holding investments in health care, higher education, and transportation should be especially cognizant of the changes to these sectors over the past several years. The local variation of municipal credit risk also requires that each investment be evaluated and understood for its own set of specific risk characteristics.

VBC offers solutions for assigning credit ratings and monitoring credit risk for municipal investments in the HTM portfolio. Making use of public ratings and reports is important, but receiving an independent credit opinion from a third party is a best practice for the examiners.

What's the potential cost of not leveraging the experience, tools, and talent VBC brings to the table?